In theory, your monthly salary should last you the entire month. 😂

Unfortunately, in reality, we have unexpected emergencies to monthly bills that always seem to increase, and those “impulse buys” that seem to catch us at our most vulnerable periods. We all tend to fall into the trap of finishing our salaries before the end of the month. Sometimes even going overboard by spending more money than we get and rack up debt in the process.

PiggyVest was built precisely to help you manage your money effectively. With our platform, you can save money, create a budget to help you manage and keep track of your living expenses, and even “pay yourself” in installments so there’s money left over to help you meet and exceed your savings targets.

We’ll explain:

Let’s assume you’re a person who earns ₦150,000 every month.

Step 1: Credit Alert

It’s Salary Day! We all know that feeling of joy when the credit alert comes in and you feel invincible and powerful — like you can do anything.

Spoiler Alert: You can’t!

You have bills presently and in the future. You need to properly plan how to spend that ₦150,000 to avoid overspending and stories that touch.

Step 2: Divide & conquer

Following the 50/30/20 method, you should save around 30% of your monthly income to meet up with your responsibilities (example rent, fuel, electricity).

As a person who earns ₦150,000, that would be about ₦45,000. So, that goes into your core savings (PiggyBank) on the PiggyVest platform [₦45,000 monthly is ₦540,000 annually!] and just keep earning interest every month.

Step 3: Stash the spending money

Now you have ₦105,000 left for the rest of the month. Your needs are unique to you. So, you may go a little higher or a little lower than the average.

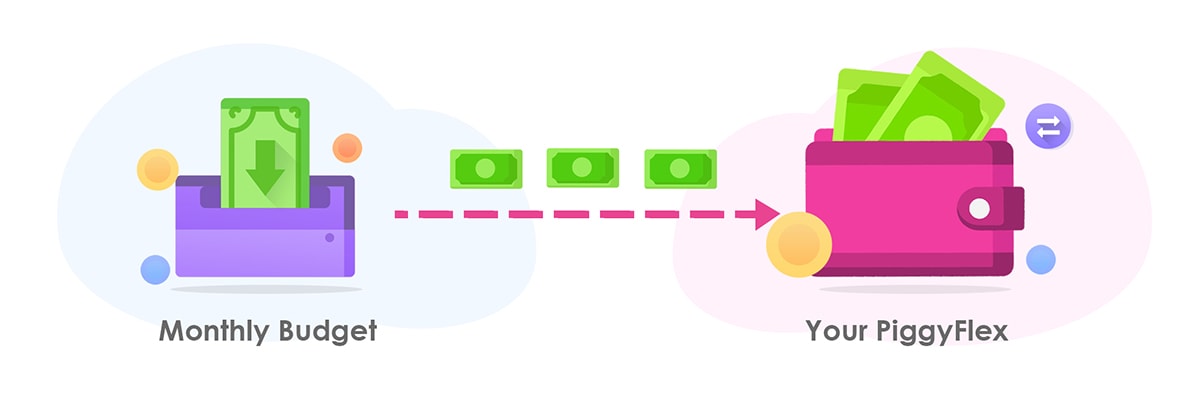

PiggyVest has a feature called PiggyFlex, a sub-account where your interests and returning funds(on maturity) are paid. You can withdraw from your flex at any time! But there’s a new twist. You can now fund your flex up to three times a month. Which brings up an interesting use-case.

With Piggyflex, you can put your entire month’s budget — say ₦100,000 — into PiggyFlex.

How?? [See Next Step]

Note: Funding your PiggyFlex is dependent on how much you have in your Core Savings (Piggybank). The threshold is calculated based on your savings in a month.

Step 4: Pay yourself weekly

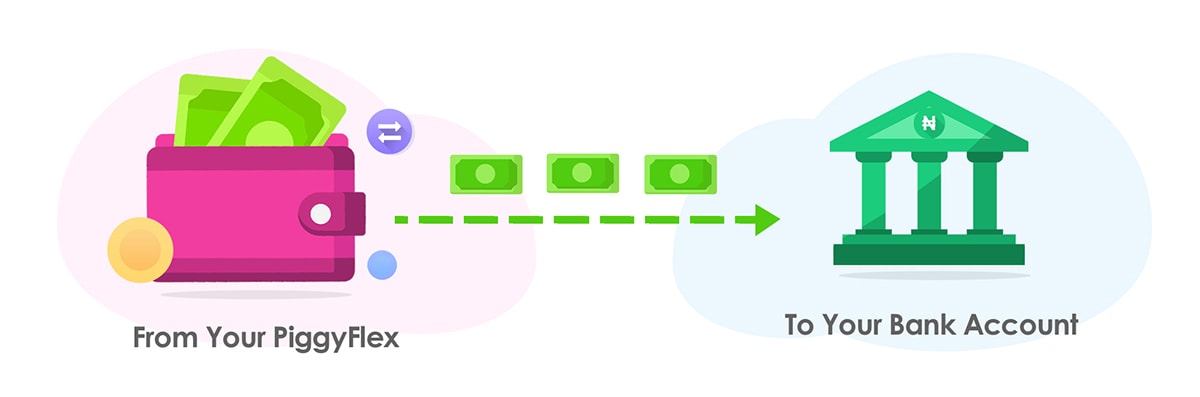

With your monthly spend in your Flex wallet, you can then effectively “pay yourself” ₦20,000 as a weekly stipend.

So every Monday, you can send ₦20,000 from your PiggyFlex to your bank account and spend it that week!

Step 5: True Flexing

Boom!… No more insufficient funds!

If you have only sent yourself ₦20,000 every week for over 4 weeks, you will have spent ₦80,000 in a month. Leaving an extra ₦20,000 for that month.

You can indulge (😒😒😒) or you can add it to your savings (😃😃😃) to exceed your overall savings target for the year.

YASSSS!!!!!

Visit PiggyVest NOW!

Money Saving Salary Investment Nigeria

About Piggybank.ng (now known as PiggyVest)

Founded in 2016, Piggyvest.com is the largest online savings & investment platform in Nigeria, targeted primarily at low- and middle-income Nigerians, helping them achieve financial freedom by providing tools to enable them better manage their finances. The company currently has over 215,000 registered users — 60 percent of whom are Nigerian Millennials — who are currently saving over N1billion monthly. Their products have helped their users maintain their savings discipline while building a savings culture.

For more information about PiggyVest, visit www.piggyvest.com

Sponsored Content

The post 5 Secret Steps on How To Make Your Salary Last Longer appeared first on BellaNaija – Showcasing Africa to the world. Read today!.