What’s Going On?

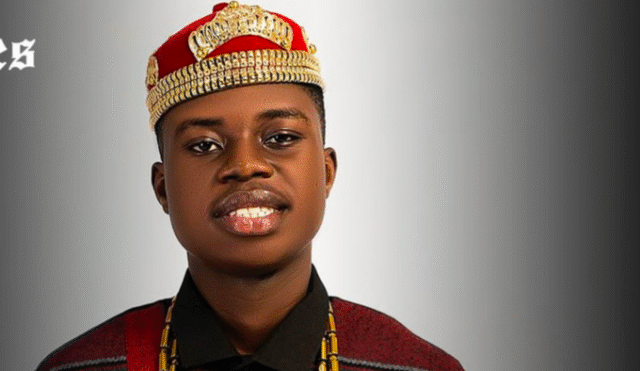

Nigerian TikTok sensation Peller has stirred controversy after publicly questioning the Lagos State Government’s demand that he pay ₦36 million in income tax. Speaking during a live session with music star Peruzzi, Peller expressed disbelief over the size of the bill, pointing out that he only recently found fame and has never received any form of assistance from the government.

“Why should I pay ₦36 million? What does that even mean? Why will the government take money from me when it has never given me anything, not even TikTok support, let alone help from a task force member?” he said.

Peruzzi responded by reminding Peller that tax payment is a legal duty for all Nigerians, revealing that his own annual tax obligations exceed the amount in question.

The Bigger Picture — Why the ₦36 Million Matters

While many sympathize with Peller’s frustration, the issue sheds light on a growing reality for Nigeria’s fast-rising content creators: tax authorities are now paying attention to digital earnings.

Key points to note:

- Income Tax Obligations: Whether income comes from a traditional job or TikTok live sessions, the law requires residents to pay personal income tax.

- Digital Earnings Under Scrutiny: Tax bodies in Nigeria have been expanding their reach to online creators and influencers as their earnings become more significant.

- Perception Gap: Many creators feel there’s a one-way relationship—where the government takes from them without providing infrastructure, digital growth support, or creator incentives in return.

Peller’s pushback reflects a broader sentiment among young Nigerians making money in the digital space: that taxation should be accompanied by visible value from the state.

How Much Does Peller Really Make?

Despite accusations that he earns an astronomical ₦200 million weekly, Peller has clarified his actual figures:

- Weekly Income: ₦15 million to ₦20 million on average, mostly from live TikTok streams.

- Live Session Earnings: About $2,000–$3,000 for a 20–30 minute live stream, three times per week.

- Occasional Peak Earnings: Up to $10,000 in a single live session, though these are rare.

These numbers suggest that if the government’s ₦36 million demand covers back taxes for a year, it may not be far-fetched—though the exact calculation has not been disclosed.

Why This Story Resonates

This clash between a high-earning TikTok creator and state tax authorities is about more than just money—it touches on:

- Youth and the Digital Economy: A new wave of Nigerian influencers are earning incomes that rival traditional careers, but laws and attitudes toward this work are still catching up.

- Trust in Government: Many creators, like Peller, question why they should pay significant sums to a system they feel offers them nothing in return.

- Global Parallels: Countries worldwide are grappling with how to tax influencer income, balancing enforcement with creator-friendly policies.

TL;DR — Summary Table

| Question | Answer |

|---|---|

| Why the ₦36M tax? | Lagos State is enforcing income tax law, including for digital earnings from TikTok. |

| Is it legal? | Yes—Nigerian tax law applies to all income, regardless of source. |

| Why is Peller upset? | He feels the government demands money without offering support or benefits to digital creators. |

| Is ₦36M reasonable given his income? | Possibly—his weekly earnings suggest it could be a backdated tax bill. |

| What does he earn weekly? | ₦15–20 million, $2K–$3K per live stream, up to $10K in rare cases. |